[Rewritten on June 20, 2024 after Fidelity made a money market fund available as the default option in the Cash Management Account. Also added a section on debit card security.]

Constancy Investments is finest referred to as an administrator for office retirement plans and a web based dealer for retail traders. Along with 401k/403b accounts, Conventional and Roth IRAs, HSAs, and taxable brokerage accounts, Constancy additionally gives accounts that can be utilized for a similar goal as a checking account and a financial savings account.

As a result of Constancy is interested by having a full relationship with its clients for each banking and investing and its major focus is on the investing half, it’s in an excellent place to supply higher charges and options than banks within the banking half.

This isn’t a sponsored publish. Constancy isn’t paying me to advertise. I’m solely writing as a glad buyer of over 20 years. Listed here are two methods to make use of a Constancy account to handle day-to-day spending and financial savings.

1. CMA as Checking

Constancy Money Administration Account (CMA) is a separate account kind from Constancy’s common taxable brokerage account formally known as “The Constancy Account.” You need to select the account kind if you open the account. A Money Administration Account can’t be modified to a daily taxable brokerage account after you open the account. Nor can an present common taxable brokerage account be modified to a CMA.

Included Options

The Money Administration Account is particularly designed to satisfy banking wants. It has just about every thing individuals want for a checking account and practically every thing is free.

– FDIC-insured stability (2.72% APY as of June 19, 2024) or a cash market fund (4.95% 7-day yield as of June 19, 2024).

– No minimal stability. No upkeep price. Doesn’t require direct deposit.

– Supplies a routing quantity and an account quantity for direct deposits and direct debits.

– Accepts verify deposits by cellular app or in particular person at a Constancy department.

– Free checkbook. No minimal quantity for writing a verify.

– Free Visa debit card for buy, ATM withdrawal, and teller money advance. It doesn’t require utilizing the debit card a minimal variety of instances monthly.

– No price to make use of any ATM worldwide. Reimburses the ATM price charged by the machine.

– Free Invoice Pay service with eBill.

– Free same-day ACH. Push $100,000 per enterprise day trip of Constancy and pull $250,000 per enterprise day into Constancy by on-line self-service. Name customer support to switch a better quantity.

– Free wire transfers. Identical $100,000 per enterprise day by on-line self-service. Name customer support to wire a better quantity.

Select Core Place

The “core place” in a Constancy account is the default holding. Cash coming into the account lands within the core place and cash going out of the account is withdrawn from the core place first.

You could have a option to maintain your core place both in FDIC-insured banks or in a cash market fund. The cash market fund isn’t FDIC-insured however its underlying holdings are short-term authorities securities. I’m snug maintaining my cash within the cash market fund for a better yield. See No FDIC Insurance coverage – Why a Brokerage Account Is Protected.

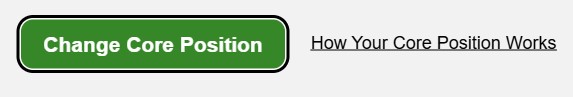

To modify from the FDIC-Insured Deposit Sweep Program to the Constancy Authorities Cash Market Fund (SPAXX), click on on the “Positions” tab and choose your money stability. You will notice a “Change Core Place” button.

Your chosen core place stays efficient till you alter it once more. In case you make Constancy Authorities Cash Market Fund (SPAXX) your core place, your present core stability and all future deposits will robotically go into the cash market fund.

The 4.95% yield from the cash market fund is greater than the yield on many high-yield financial savings accounts as of June 19, 2024. For instance, Ally Financial institution pays solely 4.2% on its high-yield financial savings account, which doesn’t have all of the checking options similar to Invoice Pay.

Routing Quantity and Account Quantity

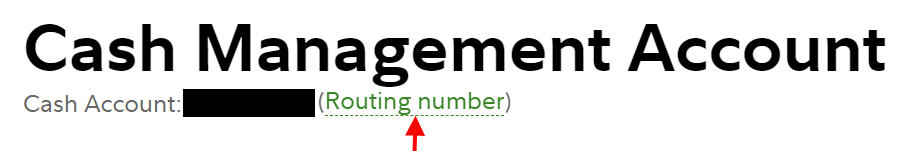

You see the routing quantity and the account quantity for direct deposits and direct debits if you click on on the routing quantity hyperlink beneath the account identify.

Select “checking” because the account kind in case you’re requested to pick out one.

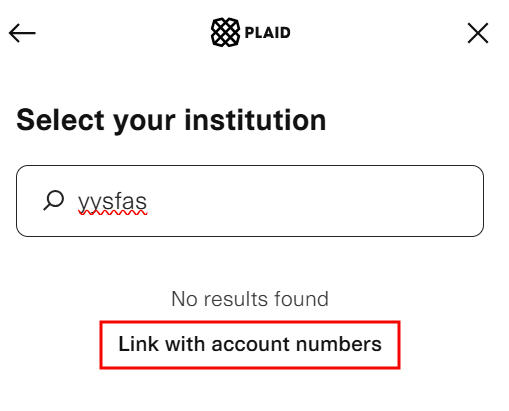

In case your financial institution makes use of Plaid so as to add a Constancy account as a linked checking account, seek for a non-existent financial institution after which click on on “Hyperlink with account numbers.” It would make Plaid use a micro-deposit to confirm your Constancy account.

You return to confirm the hyperlink after you obtain the micro-deposit in your Constancy account.

Limitations

Constancy Money Administration Account has some limitations that aren’t a deal-breaker to me.

– Doesn’t settle for deposits of bodily money or cash orders.

– Doesn’t help Zelle within the account. You may hyperlink the debit card within the Zelle cellular app.

– Doesn’t hyperlink immediately via Plaid (should undergo micro-deposits).

– Doesn’t provide sub-accounts for monitoring completely different objectives.

– Doesn’t present cashier’s checks.

– Recurring ACH pushes out of Constancy solely help month-to-month and annual frequencies. Recurring ACH pulls into Constancy solely help weekly, biweekly, and month-to-month frequencies.

– 1% transaction price on debit card purchases in overseas nations. This price doesn’t apply to worldwide ATM withdrawals.

– ACH pulls and verify deposits are held for as much as 5 enterprise days. The cash nonetheless earns curiosity. It’s simply not obtainable for withdrawal whereas it’s on maintain. You gained’t be topic to the maintain if you recognize the fitting technique to switch cash.

I take advantage of my in any other case dormant Financial institution of America checking account on these uncommon events after I have to deposit bodily money, get a cashier’s verify, or arrange recurring transfers on an odd schedule. I don’t use a debit card for purchases or monitor my financial savings by separate objectives.

The maintain time on ACH pulls and verify deposits will shrink over time for established accounts on smaller quantities. My ACH pulls and verify deposits are often obtainable for withdrawal in two enterprise days. I do an ACH push from the opposite facet after I want it to be obtainable instantly.

Safe Your Debit Card

The account robotically comes with a Visa debit card. The debit card can be utilized for purchases with no PIN when it’s run as a bank card. This creates an issue in case your debit card is misplaced or stolen. A person posted on Reddit that she or he was having a tough time getting the cash again after thieves purchased $6,000 price of reward playing cards with the stolen debit card.

It’s higher to not carry the debit card with you in your pockets. In case you choose to make use of a debit card for purchases, put the debit card in Apple Pay or Google Pay and faucet your telephone to pay. It’s harder for criminals to crack a telephone than to faucet your misplaced or stolen debit card all over the place. In case you usually don’t use a debit card for purchases, maintain it at dwelling and solely take it with you if you anticipate needing to withdraw money at an ATM.

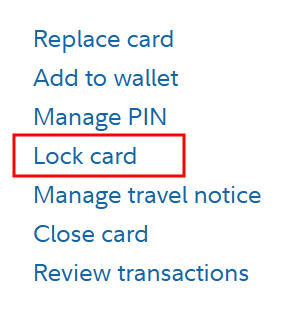

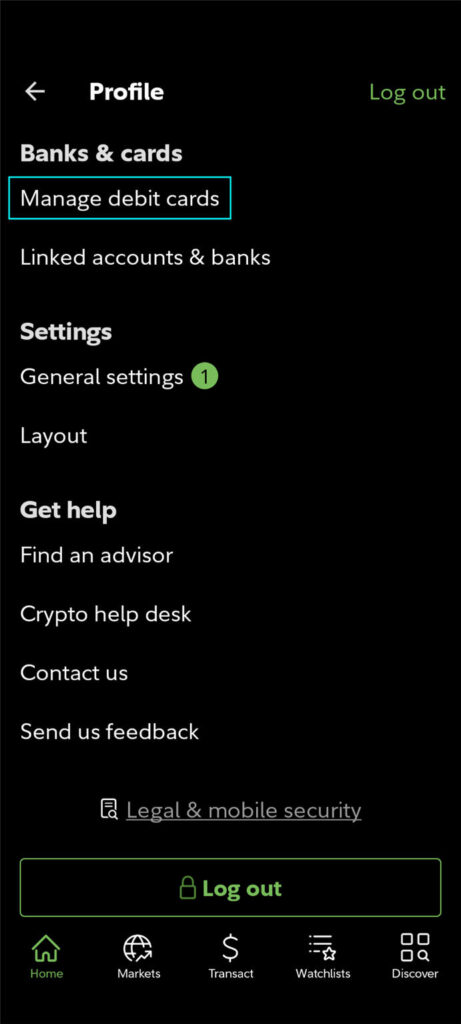

It’s also possible to lock your debit card on Constancy’s web site or within the Constancy cellular app. Locking the cardboard makes it decline all transactions. I beforehand used the debit card in Venmo to pay mates for shared bills. Venmo additionally works with a checking account. I added the Constancy account as a checking account and eliminated the debit card from Venmo. Now my debit card is securely locked always. I’ll solely unlock it after I want to make use of it to withdraw money.

To lock the debit card on-line, open a brand new tab in your browser after you log in to Constancy and go to fidelitydebitcard.com. Discover your debit card and click on on “Lock card.”

In case you set up the Constancy cellular app in your telephone, you’ll be able to unlock the debit card proper earlier than you’ll want to use the cardboard to withdraw money and lock it once more if you’re achieved. Faucet the top icon on the highest proper to search out “Handle debit playing cards” in your profile within the Constancy app. Faucet “Lock or unlock card” on the subsequent display screen to lock or unlock the cardboard.

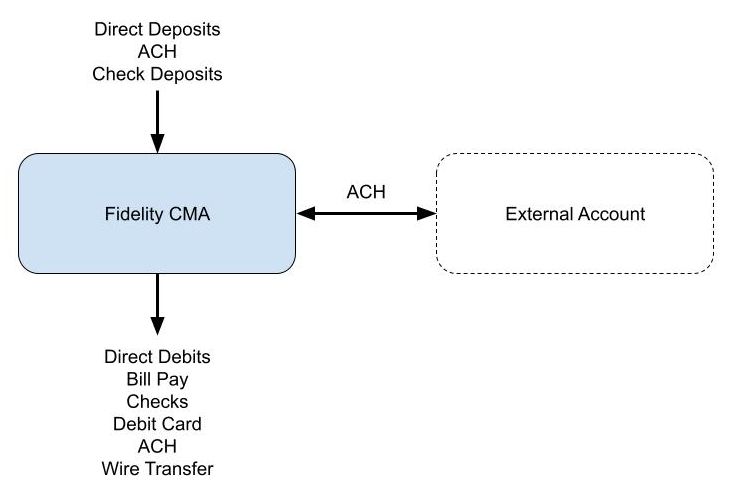

Hyperlink to Exterior Account

If you use a Constancy CMA as your checking account, you’ll be able to hyperlink it to an exterior account as you usually do with a checking account. For instance, the settlement fund in a Vanguard brokerage account pays 5.27% as of June 19, 2024. You need to use Vanguard as your financial savings account to earn a barely greater yield whereas utilizing the Constancy CMA as your checking account. The majority of your money earns 5.27% at Vanguard whereas the quantity you want for spending earns 4.95% within the Constancy CMA.

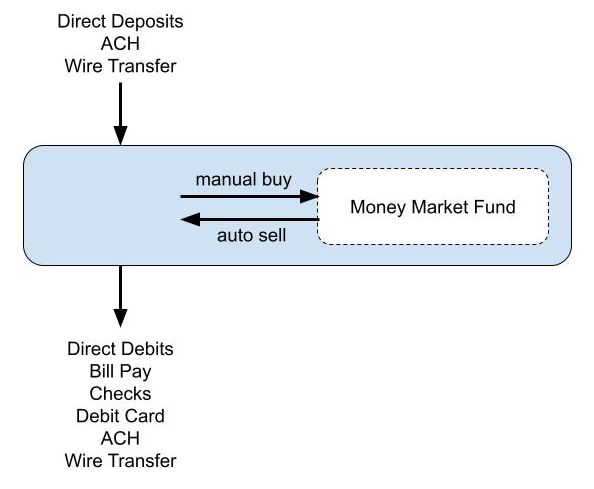

2. CMA as Checking/Financial savings Combo

As an alternative of linking to an exterior financial savings account, you’ll be able to put the cash in a special cash market fund within the Money Administration Account and maintain each checking and financial savings in the identical account.

Purchase One other Cash Market Fund

Though the CMA is designed for banking wants, it’s nonetheless a brokerage account. With some exceptions (no margin or choices), you should buy within the CMA just about every thing obtainable in a daily brokerage account. This consists of shares, bonds, brokered CDs, mutual funds, and ETFs.

The CMA turns into a checking/financial savings combo if you purchase a special cash market fund in it. The core stability within the CMA serves because the checking half and the manually bought non-core cash market fund serves because the financial savings half. Constancy will robotically promote from the non-core cash market fund when your core stability within the CMA is inadequate to cowl a debit. That is like having free automated overdraft transfers from financial savings to checking.

Some individuals choose to purchase Constancy Cash Market Fund (SPRXX) or Constancy Cash Market Fund Premium Class (FZDXX). Their yields had been 5.02% and 5.14% respectively as of June 19, 2024, which had been barely greater than the 4.95% yield on Constancy Authorities Cash Market Fund (SPAXX) within the core place. Some individuals choose to purchase Constancy Treasury Solely Cash Market Fund (FDLXX), which had a 4.93% 7-day yield as of June 19, 2024 however extra of the earnings is exempt from state earnings taxes. Not one of the these funds may be set because the default core place however you should buy them manually. See Which Constancy Cash Market Fund Is the Finest at Your Tax Charges.

As a result of Constancy will robotically promote from the non-core cash market fund to cowl debits, in case you’re so inclined, you may be aggressive in maintaining the core stability within the CMA near zero whereas maintaining the majority of your account in a special cash market fund incomes a barely greater yield. Or you’ll be able to set a most goal stability alert with the Money Supervisor to purchase extra shares of the non-core cash market fund when you’ve got extra money within the “checking” half.

Some individuals choose to simply maintain every thing within the default Constancy Authorities Cash Market Fund (SPAXX) as a result of the additional yield from a non-core cash market fund is kind of small.

Money Supervisor Not Wanted

You will have seen some convoluted setups utilizing the Money Supervisor overdraft function within the Constancy CMA. It’s pointless and undesirable.

The one factor remotely helpful within the Money Supervisor is the utmost stability alerts. An alert solely tells you that your CMA core stability exceeded the utmost goal stability. It doesn’t robotically purchase a non-core cash market fund within the CMA for you. You continue to have to purchase it manually if you would like.

You don’t want an alert for the CMA core stability dropping beneath a minimal stability when you’ve got sufficient financial savings in a non-core cash market fund held within the CMA. Promoting from the non-core cash market fund held inside the CMA to cowl debits works out of the field. It occurs robotically anyway even in case you don’t arrange something within the Money Supervisor.

The Money Supervisor has a “self-funded overdraft safety” function to hyperlink the CMA to a different Constancy account or an exterior checking account. That is pointless and undesirable if you need the CMA to face by itself. You don’t need unauthorized debits to have an effect on your different accounts.

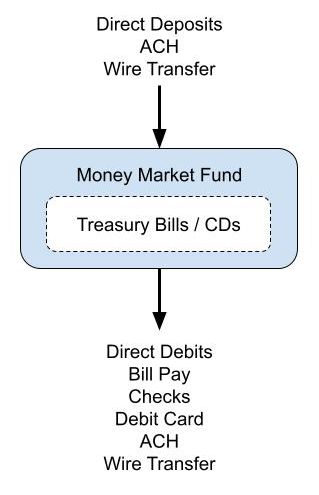

Add Treasury Payments or Brokered CDs

In case you’d prefer to take it one step additional, it’s also possible to purchase Treasury Payments or brokered CDs within the CMA when you’ve got cash that you recognize you gained’t want for a while. The CMA then turns into a checking/financial savings/CD combo. The cash robotically goes into the “checking” half when the Treasury Invoice or brokered CD matures. For instance, the quantity put aside for the subsequent property tax invoice can go right into a Treasury Invoice or a brokered CD. See How To Purchase Treasury Payments & Notes With out Price at On-line Brokers and How you can Purchase CDs in a Constancy Brokerage Account.

Please be aware in case you allow the “auto roll” function if you purchase new-issue Treasury Payments or brokered CDs within the CMA, the quantity for the subsequent roll reduces your “obtainable to withdraw” quantity for just a few days throughout the roll. A debit might fail in case you don’t have sufficient obtainable to withdraw. It’s not an issue in case you don’t use auto roll or in case you maintain a considerably greater quantity in a cash market fund than the quantity for the subsequent roll.

Utilizing a Constancy CMA for spending and financial savings turns into actually set-and-forget. All deposits robotically earn a few 5% yield as of June 19, 2024. All debits come out of this cash market fund. It’s like utilizing a financial savings account as a checking account. You may manually purchase a non-core cash market fund however you don’t must. The yield on the default Constancy Authorities Cash Market Fund (SPAXX) is shut sufficient to the yield on one other Constancy cash market fund.

You may nonetheless purchase Treasury Payments or brokered CDs to put aside cash for particular payments sooner or later. Please be aware the caveat on “auto roll” and “obtainable to withdraw” talked about above. It’s higher to do it in a special brokerage account in case you choose to make use of “auto roll.”

***

The most important draw of utilizing the Constancy CMA for spending and short-term reserves is the checking options. You successfully use a financial savings account as a checking account and earn an excellent yield from the primary greenback. All the things is seamlessly collectively.

A Vanguard cash market fund and a few much less well-known high-yield financial savings accounts pay extra however they don’t provide checking options. If you pair it with a checking account that pays near zero, the blended yield on all of your money goes down. For instance, if in case you have $5,000 in a checking account that pays 0.1% and you’ve got $50,000 in a Vanguard cash market fund that pays 5.27%, your blended yield on $55,000 is 4.8%. You may as effectively put the entire $55,000 in a Constancy CMA incomes 4.95% and eradicate the necessity to watch your checking account stability and switch forwards and backwards between two accounts.

Transitioning a checking account takes some effort and time. Banks realize it. That’s why they pay you near zero in checking accounts. They guess that you simply assume it takes an excessive amount of work to change. Don’t fall for it. It’s simpler than you assume if you take your time to make the transfer.

Say No To Administration Charges

If you’re paying an advisor a proportion of your belongings, you’re paying 5-10x an excessive amount of. Discover ways to discover an unbiased advisor, pay for recommendation, and solely the recommendation.