The Exit Ballot & Precise End result Curler Coaster:

The markets pre-maturely celebrated the exit ballot end result. The precise ballot outcome was a impolite shock with the popular celebration lacking the bulk mark. Nevertheless, there may be some solace with the NDA scoring 292 with its allies. On condition that BJP alone has bought extra seats than the entire INDIA alliance put collectively. It’s the BJP that can get invited to type the federal government and show the bulk. Chandra Babu Naidu endorsement of supporting NDA Alliance cheers the market with renewed hope.

Market Rationale preferring NDA continuity:

The market cheered the exit ballot end result and battered the market on a comparatively adversarial end result. This clearly indicated the market’s desire of the BJP led authorities below the management of Shri. Narendra Modi. These three broad elements sums up the rationale for the desire.

The market cheered the exit ballot end result and battered the market on a comparatively adversarial end result. This clearly indicated the market’s desire of the BJP led authorities below the management of Shri. Narendra Modi. These three broad elements sums up the rationale for the desire.

- Macro – Financial Fundamentals: The federal government has accomplished very properly to handle fiscal prudence and the macro-economic fundamentals.

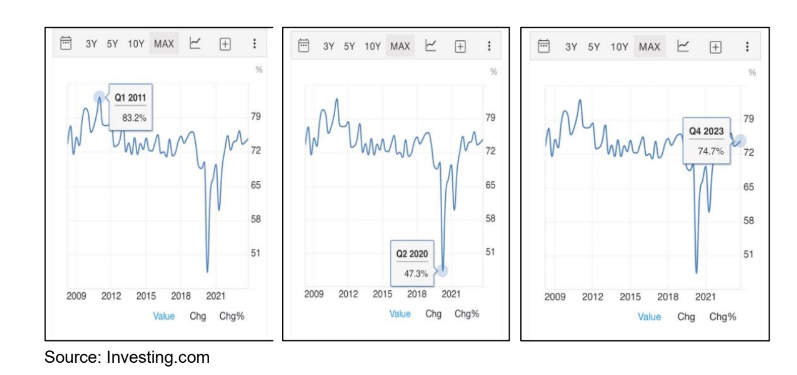

a. Present Account Deficit: India has accomplished very properly to maintain the CAD whereas preserve progress to approximate 1% ranges regardless of excessive commodity costs.

b. Fiscal Deficit: the Indian authorities managed the pandemic very properly with restricted stimulus and prudent fiscal consolidation thereafter. The GST collections have been sturdy making the fiscal consolidation train extra sustainable.

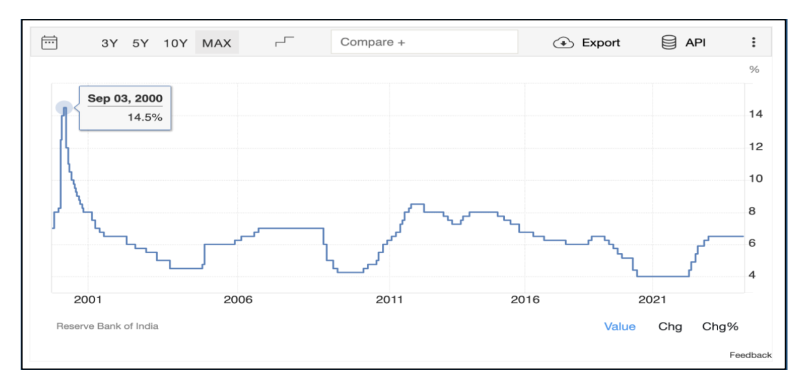

c. Inflation: RBI has maintained a hawk’s eye to handle Inflation. The federal government eased rates of interest very prudently throughout pandemic after which a managed tightening put up the identical. Additional environment friendly foreign exchange administration that navigated liquidity within the system properly. Foreign exchange intervention to assist rupee was managed properly by RBI, with out impacting inflation rather a lot. A powerful foreign exchange reserves of USD 650 Billion. A lot of the inflation in India have been primarily pushed by meals facet inflation. - Coverage Continuity: The federal government carried out a number of insurance policies selling monetary inclusion, Make in India, export progress, defence modernization, and Ayushman Bharat. Additionally they carried out the IBC, PSU disinvestment, labour, PLI schemes and GST. This, coupled with assertive overseas insurance policies, has propelled India onto a considerably higher progress trajectory. The federal government continuity below the management of Shri. Narendra Modi Ji offers confidence of coverage continuity that fosters financial progress & growth.

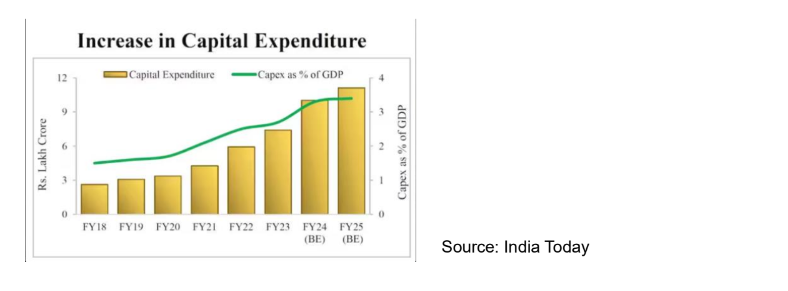

- Development Capex Increase: The federal government allotted critical quantity in the direction of the capital expenditure plan and infrastructural progress.

The India GDP preview:

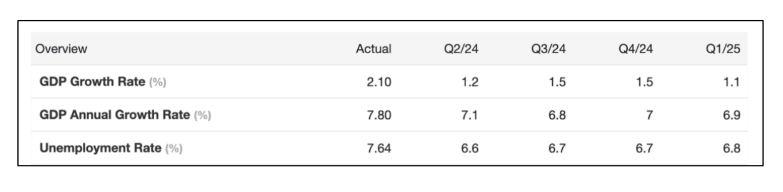

The Buyers are involved with their investments past who varieties the federal government. The GDP is an indicator of financial progress that displays within the inventory market efficiency. Throwing gentle purely from funding perspective,

Y = C + I + G + (X – M)

The GDP ( Y ) of the financial system utilizing the expenditure method is measured by the above formulation. It’s just like the 4 wheels of the automotive. The three key gamers within the above equation are Households, Companies and the Authorities.

C = Consumption of Indian households and non-profit organisations. I = Company expenditures and in addition dwelling purchases by households. G = Authorities expenditures on items & providers.

(X-M) = Internet Exports (i.e. – Export minus Import)

Consumption: The Consumption sample in India has seen a shocking divergence – The city and the agricultural divide.

We’ve got seen elevated consumption in Luxurious flats, fancy automobiles, excessive finish consumption merchandise, accommodations, flights & eating places in city India. The city inhabitants are choosing premium merchandise together with groceries, discretionary & family merchandise. The city consumption is at 1.5 to 2 instances the nationwide common.

Whereas the agricultural financial system that contains of 40% of the Indian inhabitants are struggling to come back out of the put up pandemic disaster due to excessive inflation and poor monsoon. The agricultural shoppers are both downgrading to cheaper merchandise or shifting to native manufacturers. Most listed FMCG have seen muted topline progress, given the pricing energy they’ve they’ve elevated their margin to maintain their earnings progress.

If India has to leverage the inhabitants potential, boosting consumption will result in financial progress. The anticipated regular monsoon can uplift the agricultural consumption. Rising employment and a few little bit of populist measures moderately could not impression fiscal consolidation however can alco help in boosting rural consumption. We must anticipate the price range subsequent month.

Personal Sector Spend: The capability utilisation is an indicator that sign non-public sector capital expenditure plans. The present capability utilisation is about 75%. The company homes begins so as to add capacities if the utilisation stage reaches nearer to 85% (+/- 2%). The non-public sector capex cycle will take some time earlier than it picks up.

The general financial institution credit score progress price is anticipated to say no from 16% to 14%. The company credit score progress is linked to capability utilisation & capability enlargement. The retail credit score is on the rise although. RBI is frightened in regards to the retail lending high quality tightening the grip on all of the unsecured lenders.

Having stated that we’ll see elevated capital allocation to among the new rising sectors akin to semi-conductors, electrical automobiles, photo voltaic vitality, and so forth.

Authorities Spending: The present BJP authorities has be very frugal with populist measures and have dealt with capital effectively allocation it in the direction of infrastructure and capital progress. The elevated authorities spending is aiding the GDP progress momentum. The subsequent price range will showcase how the federal government allocates capital within the new coalition regime.

India’s long run progress story stays intact however we could face some headwinds within the quick time period.

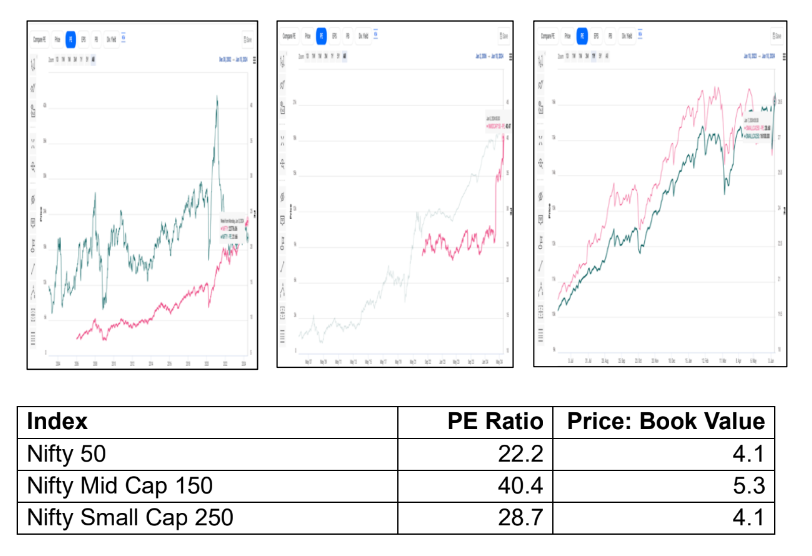

Market Valuation – Not low-cost:

The market PE for the totally different phase of the fairness market are:

The market-cap to GDP ratio is at 132% whereas the long run common is 90%+.

At this level of time the massive cap phase of the market is out there at a comparatively higher valuation. The Mid Cap and Small Cap of the market are costly.

Navigating the portfolio:

Re-balance your fairness publicity: The common EPS progress of Nifty100 firms is estimated to be 16%. The big cap firms are estimated to ship a median EPS progress of 16%. Whereas the Mid Cap and Small Cap could develop slightly extra.

Given the above we had booked revenue from the mid & small cap prior to now. Having stated that we firmly consider in asset allocation and never timing the market. Therefore, we triggered systematic switch plan after reserving revenue over a time period. It’s time we re-balance our fairness publicity and convey it a bit down.

Be cautious however don’t be afraid: Corrections within the fairness market are half & parcel of fairness investing. Any quick – time period corrections provides alternative for long-term buyers to purchase on the decrease ranges. In our perception that there’s ample liquidity to guard too massive a correction within the Indian fairness market. The systematic funding plan e book dimension of 20,000 crores+ per 30 days and greater than 250,000 Crores in dynamic asset allocation hybrid funds provides shopping for assist on account of any knee-jerk corrections. FIIs influx may add to the rally.

Lock your mounted earnings price: Within the 12 months 2000 RBI Tax Free Bonds have been accessible at 12% every year whereas many good corporates the place borrowing at an rate of interest of 16% every year.

Beforehand now we have already seen rates of interest going robe to 4%. Now with significantly better macro-economic fundamentals it won’t be any shock that rates of interest head even decrease than 4%. The period of excessive rates of interest might be over. In such a scenario one should lock within the mounted earnings returns by investing in very long run bonds or some other various alternatives accessible.

Gold: India’s improved macro – financial fundamentals will be sure that the Indian Rupee depreciate at a slower price than the typical of 4%. We preserve a optimistic stance on gold given the elevated geo-political tensions and weakening greenback fundamentals.

Please communicate together with your wealth supervisor for an in depth interplay.