“The key to getting forward is getting began. The key to getting began is breaking your complicated, overwhelming duties into small manageable duties, after which beginning on the primary one.”

Investing is usually seen as a fancy activity, particularly when markets fluctuate. However with a Systematic Funding Plan (SIP), you’ll be able to break this activity into manageable items, permitting you to speculate frequently with out worrying about market timing. One of many biggest benefits of SIP is rupee price averaging, a easy but highly effective technique that helps you purchase mutual fund items at a mean price over time, no matter market circumstances. On this article, let’s discover how SIP and rupee price averaging can work collectively to construct wealth.

What’s Rupee Value Averaging?

Rupee Value Averaging works on the precept of shopping for extra items when the market is down and fewer items when the market is up. This helps in decreasing the general price of funding. For the reason that investor continues investing a set sum frequently, it removes the necessity to time the market.

Right here’s the way it works:

· Constant Funding: You make investments the identical quantity periodically.

· Unit Value Fluctuation: The value of the mutual fund items might rise or fall over time.

· Extra Items When Low, Fewer When Excessive: You purchase extra items when the value is decrease and fewer items when the value is larger.

· Common Value Discount: Over time, the common price per unit tends to be decrease than the common market value, thanks to buying extra items at decrease costs.

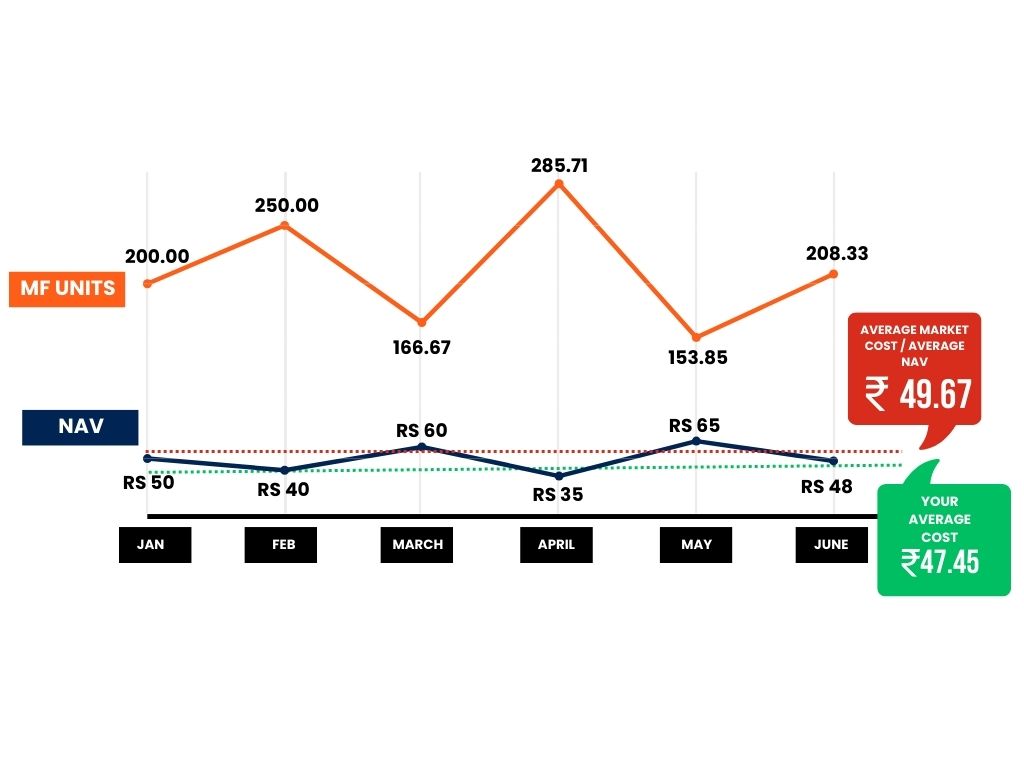

Let’s take into account a situation the place you make investments ₹10,000 each month via SIP in a mutual fund. The next desk reveals the fluctuation of the Internet Asset Worth (NAV) of the mutual fund over 6 months.

| Month | SIP Quantity (₹) | NAV (₹) | Items Bought |

| January | ₹ 10,000 | ₹ 50 | 200.00 |

| February | ₹ 10,000 | ₹ 40 | 250.00 |

| March | ₹ 10,000 | ₹ 60 | 166.67 |

| April | ₹ 10,000 | ₹ 35 | 285.71 |

| Might | ₹ 10,000 | ₹ 65 | 153.85 |

| June | ₹ 10,000 | ₹ 48 | 208.33 |

| Whole | ₹ 60,000 | 1264.56 |

In January, you got 200 items at ₹50 per unit.

In February, the market dropped, so the Internet Asset Worth (NAV) was ₹40. You obtain extra items—250 items for a similar ₹10,000.

In March, the NAV elevated to ₹60, so you could possibly purchase solely 166.67 items.

This sample continues, shopping for extra items when the NAV is decrease and fewer when the NAV is larger.

Whole Funding Over 6 Months: ₹60,000

Whole Items Bought: 1264.56 items

Now, let’s calculate the common price per unit and examine it with the common NAV over this era:

Common Value per Unit = Whole Funding / Whole Items Bought

Common Value per Unit = ₹60,000 / 1264.56 = ₹47.45

Now let’s calculate the common NAV throughout this era:

Common NAV = (₹50 + ₹40 + ₹60 + ₹35 + ₹65 + ₹48) / 6 = ₹49.67

By investing via SIP, the investor managed to decrease the common price per unit to ₹47.45, despite the fact that the common NAV throughout this unstable interval available in the market (fluctuating from ₹35 to ₹65) was ₹49.67. That is the essence of Rupee Value Averaging.

Now, suppose you make investments your complete ₹60,000 directly in January when the NAV is ₹50.

Items Bought = ₹60,000 / ₹50 = 1200 items

Whole Worth at Finish of June (NAV of ₹48) = 1200 × ₹48 = ₹57,600

Whereas, while you make investments ₹10,000 each month for six months, as within the SIP instance above,

Whole Worth at Finish of June (NAV of ₹48) = 1264.56 × ₹48 = ₹60,698.90

| Funding Kind | Whole Funding (₹) | Items Bought | Whole Worth at June’s NAV (₹48) |

| Lumpsum | ₹ 60,000 | 1200 | ₹ 57,600 |

| SIP | ₹ 60,000 | 1264.56 | ₹ 60,698.90 |

With SIP, you bought 64.56 extra items than you’ll have with an funding made fully at the beginning. That is the good thing about rupee price averaging—by spreading your funding over time, you scale back the danger of market timing and decrease the common price per unit.

Why Rupee Value Averaging is Helpful

Avoids Market Timing: SIPs get rid of the necessity to time the market. As a substitute of worrying about when to speculate, you mechanically make investments at common intervals, which reduces the emotional stress of timing the right market entry.

Smoothens Market Volatility: By investing frequently, you reap the benefits of market fluctuations. When costs drop, you get extra items, and when costs rise, your funding grows. This smoothens the influence of market volatility.

Decrease Common Value: As seen within the instance, the common price per unit via SIP was decrease than the common market value in the course of the funding interval.

Compounding Advantages: SIPs, when maintained over lengthy durations, profit from the facility of compounding. The returns in your investments are reinvested, additional accelerating wealth progress.

Conclusion

SIP is a extremely efficient option to accumulate wealth over time with out worrying about market timing. By using Rupee Value Averaging, SIPs show you how to decrease the common price of your funding, leading to larger returns particularly throughout unstable market circumstances.